Insolvency and Bankruptcy Practice

Insolvency and Bankruptcy Practice: We advise lenders and investors at all levels of the capital structure as well as corporates/directors, central banks, insolvency officeholders/trustees and government institutions.

Our experts on Insolvency and Bankruptcy Code, 2016 advise on the large and complex restructurings of distressed assets along with contingency planning, debt restructuring, distressed acquisitions/sales, credit bidding, formal insolvency proceedings, out-of-court refinancing and distressed debt trading.

We advise lenders and investors at all levels of the capital structure as well as corporate/directors, central banks, insolvency officeholders/trustees and government institutions.

We work closely with specialists in related practice areas including finance, corporate, real estate, employment, tax, regulatory, capital markets and litigation to provide an all-around service.

Insolvency and Bankruptcy Code, 2016

Insolvency and Bankruptcy Code, 2016 provides a time-bound process for resolving insolvency in companies and among individuals.

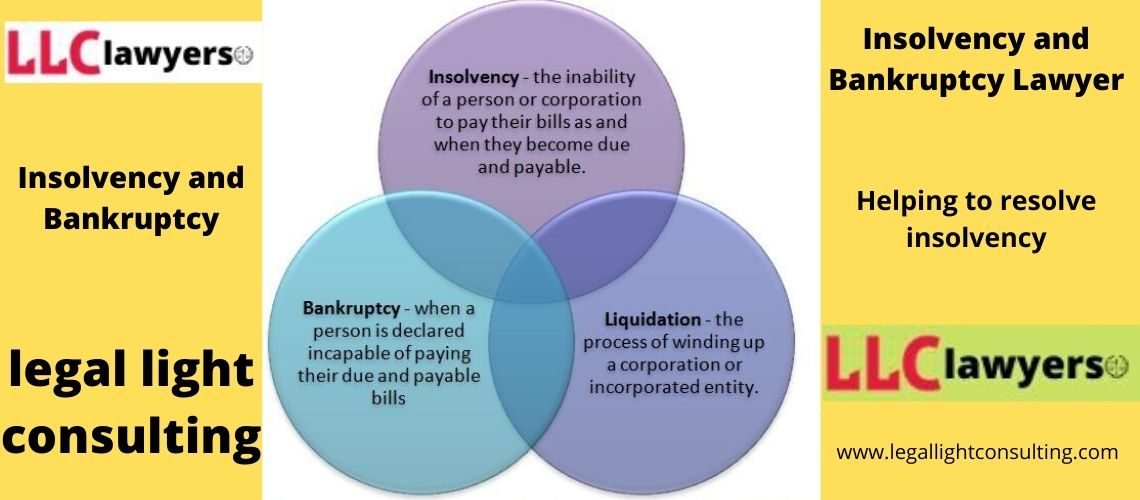

Insolvency is a situation where individuals or companies are unable to repay their outstanding debt.

Bankruptcy, on the other hand, is a situation whereby a court of competent jurisdiction has declared a person or other entity insolvent, having passed appropriate orders to resolve it and protect the rights of the creditors.

It is a legal declaration of one’s inability to pay off debts.

The Government implemented the Insolvency and Bankruptcy Code (IBC) to consolidate all laws related to insolvency and bankruptcy and to tackle Non-Performing Assets (NPA), a problem that has been pulling the Indian economy down for years.

The Code is quite different from the earlier resolution systems as it shifts the responsibility to the creditor to initiate the insolvency resolution process against the corporate debtor.

The recently proposed amendments aim to remove bottlenecks, streamline the corporate insolvency resolution process, and protect the last mile funding in order to boost investment in financially distressed sectors.

Process of Initiation of Corporate Insolvency Resolution process :

An operational creditor may, on the occurrence of a default, deliver a demand notice of unpaid operational debtor copy of an invoice demanding payment of the amount involved in the default to the corporate debtor in terms of section 8 of the Insolvency & Bankruptcy Code, 2016.

The corporate debtor shall, within a period of ten days of the receipt of the demand notice or copy of the invoice mentioned in sub-section (1) bring to the notice of the operational creditor

(a) existence of a dispute, if any, and record of the pendency of the suit or Arbitration proceedings filed before the receipt of such notice or invoice in relation to such dispute;

(b) the repayment of unpaid operational debt—by sending an attested copy of the record of the electronic transfer of the unpaid amount from the bank account of the corporate debtor; or by sending an attested copy of a record that the operational creditor has encased a cheque issued by the corporate debtor.

After the expiry of the period of ten days from the date of delivery of the notice or invoice demanding payment under sub-section (1) of section 8, if the operational creditor does not receive payment from the corporate debtor or notice of the dispute under sub-section (2) of section 8, the operational creditor may file an application before the NCLT for initiating a corporate insolvency resolution process, in terms of section 9 of Insolvency & Bankruptcy Code 2016.

An operational creditor initiating a corporate insolvency resolution process under this section may propose a resolution professional to act as an interim resolution professional.

The Adjudicating Authority (NCLT) shall, within fourteen days of the receipt of the application under sub-section (2), by an order –

- Admit the application and communicate such decision to the operational creditor and the corporate debtor if,

- the application made under sub-section (2) is complete;

- there is no repayment of the unpaid operational debt

- the invoice or notice for payment to the corporate debtor has been delivered by the operational creditor;

- no notice of dispute has been received by the operational creditor or there is no record of dispute in the information utility; and

- there is no disciplinary proceeding pending against any resolution professional proposed under sub-section (4), if any.

- Reject the application and communicate such a decision to the operational creditor and the corporate debtor, if

- the application made under sub-section (2) is incomplete;

- there has been repayment of the unpaid operational debt;

- the creditor has not delivered the invoice or notice for payment to the corporate debtor;

- notice of dispute has been received by the operational creditor or there is a record of dispute in the information utility; or

- any disciplinary proceeding is pending against any proposed resolution professional.